Blog Layout

COVID IMPACT ON SALES AND PHARMA ACTIVITIES: ONE YEAR LATER

Simone Rebora • giu 30, 2021

Basically, across countries, Covid-19 has negatively impacted pharma sales evolution, but positive signals are coming from the overall promotional volume and F2F interactions improved compared to 2020

According to Bloomberg, the biggest vaccination campaign in history is underway. More than 2.71 billion doses have been administered across 180 countries, according to data collected by Bloomberg. The latest rate was roughly 41.7 million doses a day. In the U.S.A. 319 million doses have been given so far. In the last week, an average of 1.05 million doses per day were administered. Enough doses have now been administered to fully vaccinate 17.7% of the global population—but the distribution has been lopsided. Countries and regions with the highest incomes are getting vaccinated more than 30 times faster than those with the lowest incomes.

In the U.S., the latest vaccination rate is 1,048,167 doses per day, on average. At this pace, it will take another 5 months to cover 75% of the population. Israel was first to show that vaccinations were having a nationwide effect. The country has led the world in vaccinations, and by February more than 84% of people ages 70 and older had received two doses. Severe covid cases and deaths declined rapidly. A separate analysis in the U.K. showed similar results.

It’s now a life-and-death contest between vaccine and virus. New strains threaten renewed outbreaks. In the early stages of a campaign, the effect of vaccinations are often outweighed by other factors of transmissibility: virus mutations, seasonality, effectiveness of mask use and social distancing. In time, higher vaccination rates should limit the Covid-19 burden around the world.

FOCUS ON EUROPE

According to the latest IQVIA analysis, a summary of the situation of the G5 is as follows:

- ITALY: Italy changed its vaccination guidelines to prioritize the elderly; Initially Italy prioritized vaccinating health workers followed by nursing home staff, over 80s and people with serious conditions but since Mar 2021, the govt. is prioritizing elderly people over other groups.

-

GERMANY: Germany’s vaccine rollout is at slow pace compare to other countries, but they aim to hasten it with flexibility. Highest priority group (80+ age group & health workers) has been vaccinated in most German states; vaccination is ongoing onto second group (70+ age group, people with serious illnesses and primary school teachers).

-

SPAIN: Spain’s vaccination strategy has progressed to the mass vaccination phase. The Spanish govt. prioritized vaccinating people based on health condition, essential and high exposure job roles and age, in late March and early April most regions finished vaccinating their 80+ age group and are now proceeding with those in 70s.

-

FRANCE: France ramps up its vaccine rollout; currently vaccinating all aged 55+. In the first vaccination phase elderly people and staff in nursing homes, healthcare workers, firefighters, home helpers aged 50+ and 75+ were vaccinated. Anyone over the age 55 is now eligible for vaccination, however few professions are prioritized.

-

UK: UK is one of the world’s front runners in terms of vaccine coverage. Everyone over the age of 50 and high-risk categories population received their first vaccine dose before April 15, 2021. Currently the govt. has vaccinated people below the age of 50.

OVERVIEW OF COVID-19 AND ITS IMPACT ON SALES ACROSS US AND G5

Basically, across countries, Covid-19 has negatively impacted pharma sales evolution, but positive signals are coming from the overall promotional volume and F2F interactions improved compared to 2020. Going through a deep analysis country by country, we can see that:

- Italy Italian hospital market showed a YTD decline of ~21% compared to

2020; Within top 5 classes alimentary tract & metabolism was worse affected, while F2F detailing still holds major share of the market; Overall promotion has improved significantly compared to 2020 but still lower than 2019.

- Germany German hospital market showed a decline of ~16% in February 2021 compared to the same month last year, while Postal mailing and E-mail holds major share of promotional volume; F2F interactions show growth compared to 2020.

- Spain Spanish hospital market showed a YTD decline of ~12% compared to the same period last year; Growth in antineoplastic & immunomodulating agents but concerning F2F interactions share has started to improve compared to 2020.

- French French hospital market showed YTD decline compared to 2020 whereas antiparasitic, insecticides & repellents category showed growth since Jan’21, while F2F interactions has started gaining more share in Promotional volume

- UK UK hospital market has shown a YTD decline of ~9% compared to the

same period last year; Musculo-skeletal category showed growth in 2021 and the overall promotion shows growth compared to 2020; Email &

Postal Mailing holds major share of promotional volume.

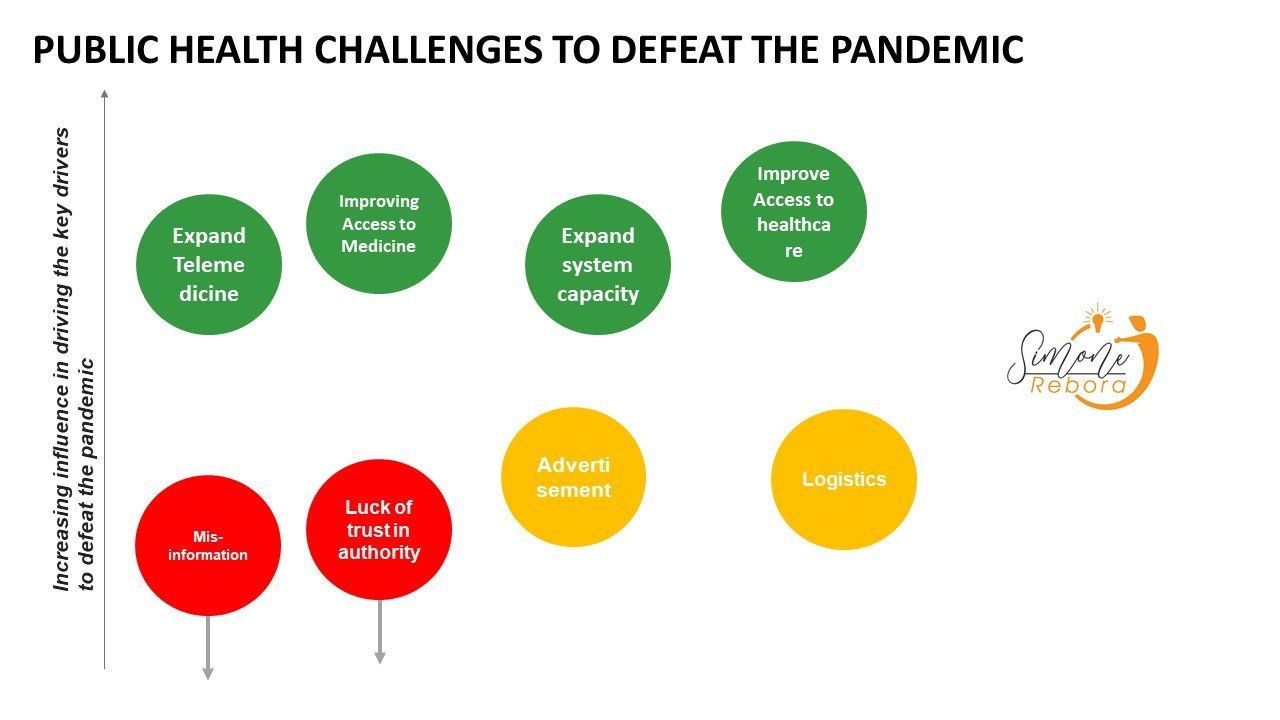

NEXT PUBLIC HEALTH CHALLENGE TO DEFEAT THE PANDEMIC

Healthcare around the world is at a crossroads, with financial pressures undermining the sustainability of health systems. As highlighted by the European Steering Group on Sustainable Healthcare, a sustainable healthcare requires a shift from treatment of established disease to disease prevention and early diagnosis, and it relies on the need to engage citizens to take greater responsibility for their health in order to establish a more participatory healthcare model, instead of a paternalistic one. From my personal perspective, countries, in order to improve their position to defeat the pandemic, should implement 4 different drivers:

1) Expand Telemedicine, reimbursing it at the same rate as in person; permit telemedicine for first time visit, expand approved technologies and audio only visits.

2)

Improving Access to Medicine, permitting early refills, expanded Rx size and remove prior authorization; permit home drug deliveries and network of pharmacies, expanded patient assistance programs

3)

Expand system capacity, permitting licensed physicians in good standing to work across state borders, allow states to mobilize inactive physicians into workforce, value domestic production for drugs and supplies

4)

Improve Access to healthcare, reopening of healthcare exchanges in many states, improve and ease access and care, covered costs of all COVID-19 testing and treatments

To conclude, furthermore, we could identify meaningful areas of acceleration that can boost the recovery post-COVID-19; for instance and from my personal point of view:

investments in the newer technologies for vaccines, remote site monitoring & activation, novel trial design, digital patient engagement and accelerated Real World Evidence.

Condividi

Tweet

Condividi

E-mail

Autore: Simone Rebora

•

31 ago, 2023

Storytelling in healthcare marketing is a tool that allows you to tell a story using sensory language presented in a way that enables listeners to internalise it, understand it and create their own meaning. Your customers do not buy your product or service. They buy the emotion you make them feel.

Autore: Simone Rebora

•

01 mar, 2023

Most of the decisions people make are not based on logic. The hippocampus, the logical part of the brain, is only 2% of the brain. So, if we want to change people's behavior, their logic is the weakest tool. To change behavior, pharmaceutical brands have to tap into emotions.